Cheers to a safe and festive holiday season! Enjoy time with family and friends, and make sure to experience some of the wonderful events headed our way in Denver this December.

Southwest Rink at Skyline Park (November 24 - February 15) "Ready. Set. Skate. Skyline Park is the place for fun this holiday season. Southwest Airlines and the Downtown Denver Partnership invite you and your family to join us for FREE skating at the Southwest Rink at Skyline Park, located at 16th & Arapahoe in Downtown Denver. Ice skating is free! You may bring your own skates or rent a pair for just $2" Blossoms of Light (Nov 27 - Jan 2) "Embrace the holiday season at Blossoms of Light. Over one million colorful lights draped in elegant designs highlight the Gardens winter beauty. Enjoy sparkling passages, brand new displays and romantic mistletoe kissing spots, as well as the always anticipated HoloSpex glasses. Warm drinks and tasty treats will also be available. Seasonal entertainment will be available on select evenings." Denver Zoo Lights (Dec 4 - Jan 3) "Zoo Lights will nearly double in size this year, spanning 70 acres of Denver Zoo's campus, with nightly entertainment, animal encounters, Santa meet-and-greets and, of course, illuminated animal sculptures that swing through trees, jump across lawns hide in bushes and appear in places where they're least expected." Parade of Lights (Dec 4 and 5) "The FREE holiday spectacular features marching bands, ornate floats, and, of course, a special appearance by Major Waddles the Penguin and Santa! Grab your hot chocolate and ear-muffs, this year is going to be better than ever!" A Christmas Story, The Musical (Dec 16 - 27) "Direct from Broadway, A Christmas Story, The Musical, nominated for three 2013 Tony Awards including Best Musical, comes to hilarious life onstage! The Associated Press calls it 'a joyous Christmas miracle'." Jingle Bell Run/Walk (December 13) "Chosen as one of the Most Incredible Themed Races, Jingle Bell Run/Walk for Arthritis is a fun and festive way to kick off your holidays by helping others! Wear a holiday themed costume. Tie jingle bells to your shoelaces. Raise funds to help find a cure for arthritis." TubaChristmas (December 20) "Tap your toes to your favorite holiday tunes at the annual TubaChristmas concert in Skyline Park. Featuring 300 tuba players from all over the region, TubaChristmas is one of the most celebrated and longest-running holiday festivities in Colorado" New Years Eve Fireworks (December 31) "To welcome the arrival of 2016, the New Year's Eve Fireworks Downtown will once again fill the skies twice during the evening. The first show, at 9:00 p.m. will entertain families and others looking for an early celebration, while the second show officially marks the start of the New Year at midnight. The two fireworks programs are identical." I hope you enjoy all that Denver has to offer this holiday season! Cheers!

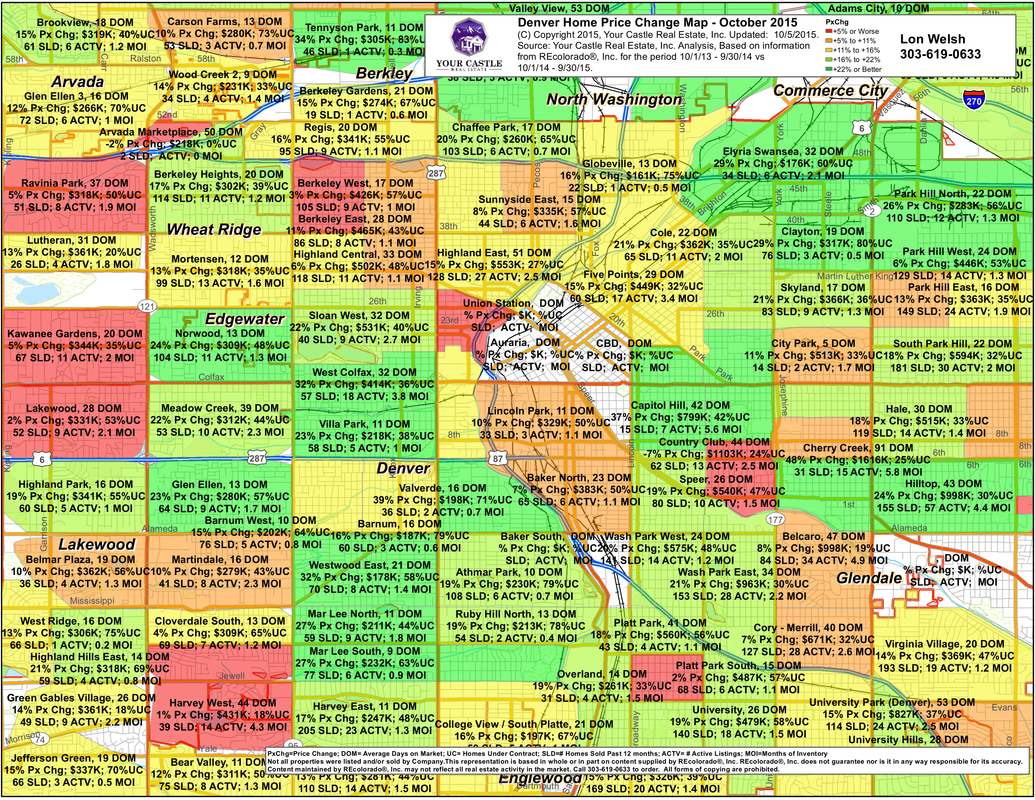

There is a lot of talk about the booming real estate market in the Denver area. We read almost weekly about how much prices have appreciated, how low the available home inventory is, etc, across the Denver area. Often times however, the articles we read in the local publications do provide a great overall picture, but fall short of providing specifics that buyers and sellers can find helpful. Often times, micro-markets in the various neighborhoods across the entire Denver metro area differ from that of the overall whole.

This is where the Price Change Map can step in and fill in the gaps. Whenever I am working with a buyer or seller, I like to dive into this to paint a more specific picture of what their neighborhood market looks like. From this, we can determine how it applies to them and what we need to do to best be prepared for buying and/or selling. Take a look at our most recent Price Change Map for Central Denver:

There are a few key elements that this map provides by neighborhood/area:

1. Average Days on Market of sold homes. 2. Average price appreciation over the last 12 months. 3. Average sold price. 4. Percentage of homes Under Contract as of the end of the quarter. 5. Number of homes sold over the last 12 months. 6. Number of homes currently active as of the end of the quarter. 7. Available Months of Inventory (MOI) based on the current absorption rate. Each of these elements provides specific data that can be used in positioning for buying and selling. For example, I've noticed that in some local markets, the available MOI is actually higher, allowing for more buyer opportunities. What a great thing! :) Enjoy the map, learn about your area of interest, and let me know if you'd like me to dive into anything discussed here a little more. Thanks for reading!

I'm frequently asked where the real estate market is headed and when we will get back to some kind of equilibrium. The truth is it's extremely difficult to accurately predict the future, but here's what I know: Right now we are experiencing one of the strongest seller's markets in our history, and we're a full six and a half years into this market recovery. The reason is simple: We have much more demand for homes (buyers) than we have supply of homes (sellers). What's fascinating to watch is the dynamic build on itself. It looks something like this:

In the meantime, if you've thought about selling your home, now might be a great time to find out what the market is like in your neighborhood and see what your home is worth. It's almost certainly worth more than it was just a few years ago. Drop me a line, and I'll put together a professional Competitive Market Analysis on your home so you have the data to make the right decision. Another question my potential sellers often ask is if they sell today, can they find a replacement home in time to move? In a market like ours this is a very good question. Fortunately, there are a number of things savvy sellers can do to take advantage of the seller's market and put themselves in a good position when looking for their replacement home. Here are a few:

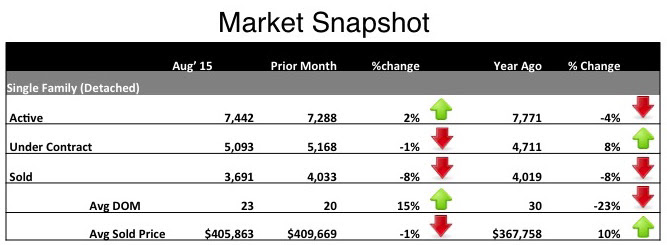

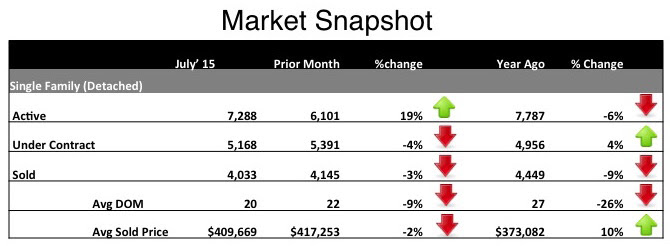

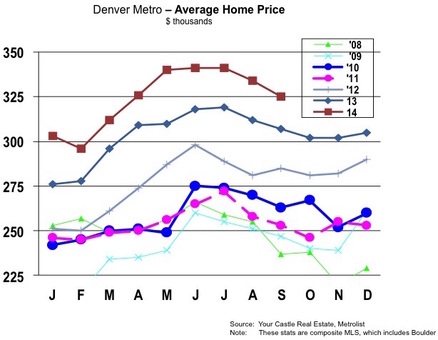

As we near the end of the summer selling season, our housing market continues to march forward. Every month since February has brought a record high average home price in the metro Denver area, with average prices approaching an astounding $425,000. Amazingly, half of all Denver's new homes for sale sell in six days or less, which is the fastest in the country. The latest Case-Schiller report says we have the highest 12 month price increase of any of the Top 10 Cities it tracks (Denver 10 percent price increase, San Francisco 9.7 percent and Dallas 8.4 percent). The strength in the market has been so pronounced that logical, informed people are beginning to ask whether we're setting ourselves up for anotherbubble. Good question. While no one can ever predict the future with certainty, I see no evidence that we're heading for a dramatic downturn in the real estate market any time soon. Here's why:

Just had a to put a quick note in here about my wife and I beginning the adoption process. For access to our adoption blog and fundraising progress, please click on the link below:

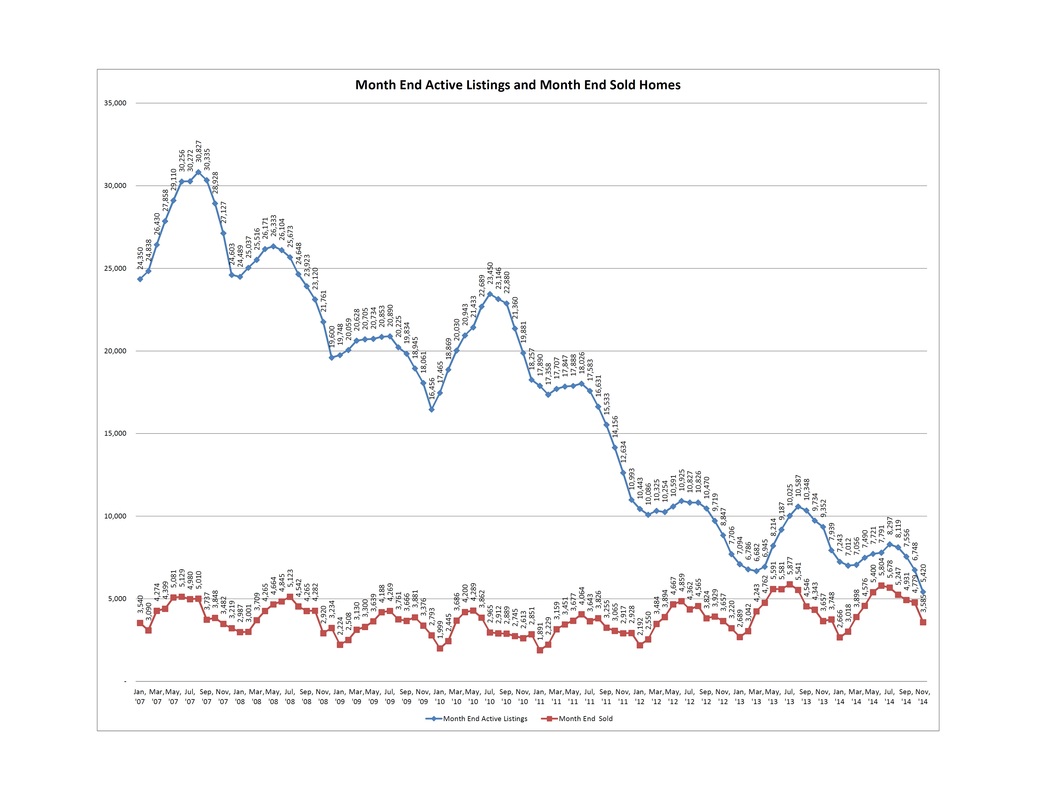

The Downtown Denver Partnership recently published a Downtown Denver Development Update. This 1 page report provides a quick snapshot of projects currently proposed, underway, and recently completed in the downtown Denver area. Take a look and see how Denver's urban core is growing. Denver home inventory continues to be at record low numbers in comparison to the last several years. See the chart below. This graphic visualizes number of homes sold vs available homes for sale in the Denver metro area. What does this mean for you?

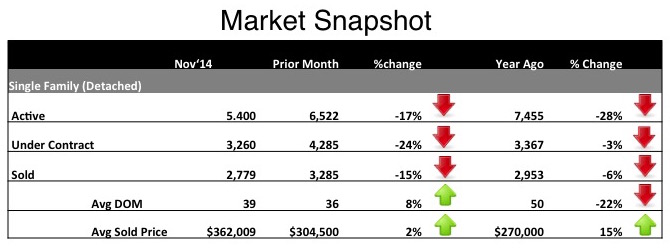

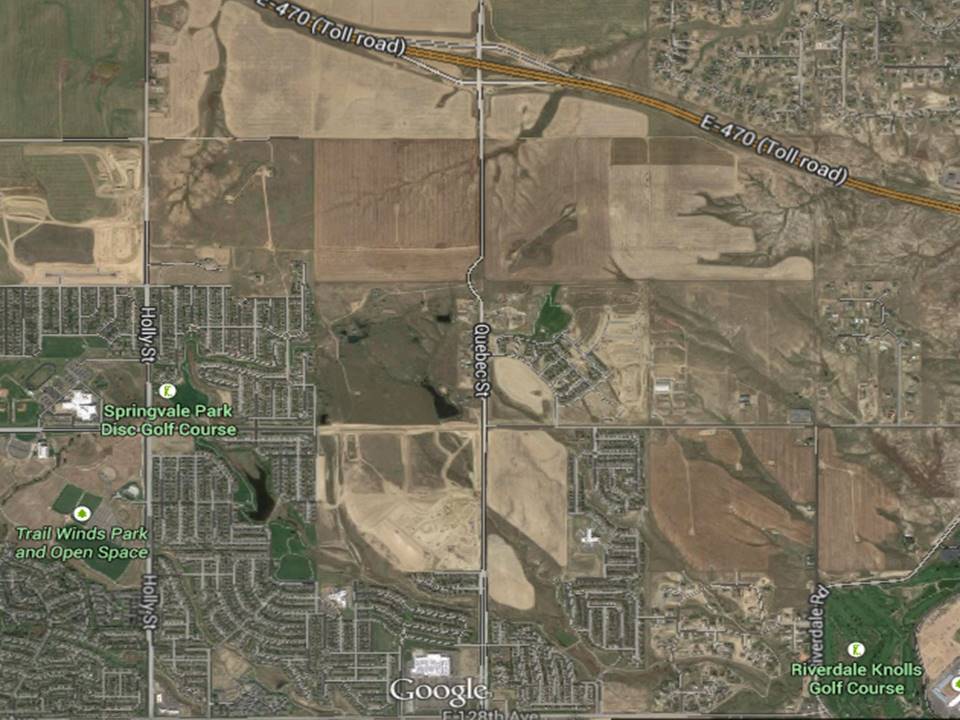

For buyers: The number of homes for sale is very low. Therefore, the number of competing buyers per home is much higher than the "norm". That means you'll most likely find yourself in a multiple offer situation competing with several other buyers for the same house - this situation is compounded in highly desirable neighborhoods. As a buyer, you'll have to be very prepared mentally and financially to compete to win the house you love. I'll post another article about being prepared as a buyer soon. For sellers: A low home inventory situation can create desirable conditions for selling a home. Having more buyers competing for your home gives you the greatest opportunity to achieve the price and terms that are most favorable to you. However, each specific area/neighborhood's market conditions must be individually evaluated to properly prepare for a sale. Also, you must still adhere to the fundamentals of evaluating marketing, home condition, and price - these are essential to the home selling process and can never be ignored, regardless of market conditions. I'll post another article about preparing a home for sale in the near future.  Every December I like to review what the real estate market experienced in the past year and see where we think it'll head in the New Year. Overall, I'm extremely pleased with what we've experienced in the past 12 months and am bullish on the future. I expect the economy to continue to improve (there are no shortage of articles about the growing job market and healthy economy of our great state) and our metro Denver housing market to stay strong but, critically, not overheat. Here are a few different metrics I use to evaluate the market and help you understand it better. For each, I'll briefly describe what 2014 looked like and where I think we're headed. Market strength - 2014 was a strong sellers' market. We still have near record low inventory of homes for sale which is keeping the demand for housing strong. Prices are up about 9 percent in 2014 making homeowners (and real estate investors!) very happy. I expect 2015 to continue to be a sellers' market but I see no sign of a major imbalance in the market that could lead to any sort of ugly peak and crash. Overall, I expect home prices to continue to rise but a somewhat slower pace in 2015, about the long-term average of 6 percent. Rental vacancies - The rental market is as strong as it has ever been in metro Denver. The vacancy rate for 1-4 unit properties is at a near record low 2 percent! Rents are rising faster than they ever have in the past. As a result of the rising rents, we are beginning to see more renters deciding it's time to buy instead of suffering through continual rent increases and tougher application processes. In addition, more and more homeowners who experienced hardships during the downturn, lost their homes and have been renting ever since, are now able to purchase a home again as their ability to finance a purchase recovers. This is great news for the market and will certainly lead to more sales in 2015, continuing to support our sellers' market. It's very interesting to study the relationship between the rental market and the sales market: the tighter the rental market, the faster rents go up, the more likely renters are going to become buyers, the more it strengthens the sales market. Interest rates - We had a big jump in interest rates in June 2013 as the economy showed signs of improvement. But, much to everyone's surprise it didn't put much of a damper on the housing market. Since then rates have drifted downward helping to keep homes relatively affordable. No one knows exactly what interest rates will do in the future, despite what all the screeching cable news networks say! I foresee continued improvement in the economy, both locally and nationally, over the next year so my best guess is that interest rates may rise a little in 2015, but only a little. 2015 is still going to be a great year to buy a home. Someday down the road we'll see interest rate hikes, but for the foreseeable future I don't predict any major jump in rates. The Economy - Let's talk a bit more about the economy. The metro Denver economy is very strong, with unemployment down to 4.7 percent. Despite the fear of a spike in inflation it has stayed extremely low, in the range of 1-2 percent. Consumer confidence is at its highest point in five years and will continue rising. Nothing can be better for our housing market than a slowly but surely improving economy. In a steadily improving economy buyers and sellers behave rationally and buy and sell in a controlled environment, based on solid personal, financial, and economic reasons. At the same time it avoids the problems associated with an overheated market where prices pop then crash like we experienced during the last downturn. This is what real estate market dreams are made of. When all's said and done, I can't wait for 2015! I want to wish you and yours a very Merry Christmas and Happy New Year! I wanted to briefly highlight an area of northeastern Thornton which I think is a hidden gem. This area is primarily north of 128th Ave around the north/south running streets of Holly and Quebec as indicated by the map above. I think it's a great area for several reasons: 1. The newly opened Quebec exit on the E-470 tollway provides residents of this growing area quicker commuting times to large employment centers around the metro area. Here are a few examples of commute times:

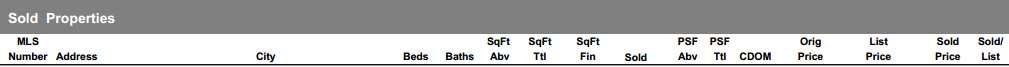

2. There's no shortage of great parks and open space nearby. In fact, within a short distance are 4 major parks, a golf course, an aquatic center, and a full disc (frisbee) golf course. Great for families, great for athletes, great for outdoor types. It's also a great location for cyclists, with plenty of open roads to ride (including a few hills) and easy access to the S Platte River trail which can take you all the way into Denver (or to Chatfield Reservoir if you're feeling adventurous). 3. Real Estate is super affordable. Yes, home values continue to appreciate at a steady rate, but the average price of homes sold over the last 12 months has been a little under the average for the entire Denver metro area. Check out the sold data below: As we can see, the average sold price was $328,330 with the average home selling at 93% of asking price (this includes resale and included new builds in the MLS). However, the median price sold was only $309,900 which provides a little better insight into prices in the area.

New build homes do continue to go up in the area as well which does naturally raise the cost of buying into an area. I was recently reviewing a few new homes nearby and here are a few example of new build pricing: 1. 3600 SF, 5 bed, 4.5 bath, 3 car garage: $574,000. 2. 1782 SF, 2 bed, 2.5 bath, 3 car garage: $430,000. 3. 3154 SF, 4 bed, 3.5 bath, 3 car garage: $483,674. What this tells me is that many home options exist if considering living in this area - the range of pricing in the area can really appeal to many types of families and buyers. If you're ever interested in seeing the types/styles of homes available in northeast Thornton, CO, feel free to give me a call or send me an email. Always happy to discuss real estate with anybody and provide meaningful data and advice for specific areas! |

|

Your Denver Area Real Estate Expert

Proudly powered by Weebly